Bare metal, private and public clouds are different not only in a way how your resources are provisioned and maintained, but in a way your procurement and financial departments should treat and deal with them.

Bare metal and private clouds in the majority of the cases are about CapEx, when companies purchase and upgrade hardware and software licenses in some cycles, lease space and power, and pay salaries to personnel. Public clouds are based on OpEx with monthly or annual bills and a mindset of leasing but not owning. If you are a small company, it’s not a big deal to adjust your processes, but for a huge company it’s a real pain: private clouds with CapEx, public with OpEx, engineering teams provisioning resources in multiple locations and without any limits in public clouds transforming into enormous bills, financial departments having on-premise and public resources and different accounting categories. All this is a big obstacle for cloud adoption across big companies and the reason they still prefer not to go hybrid cloud.

To eliminate the barrier, FinOps methodology was created and is actively developing nowadays with thousands of practitioners and enterprise companies as members and sponsors.

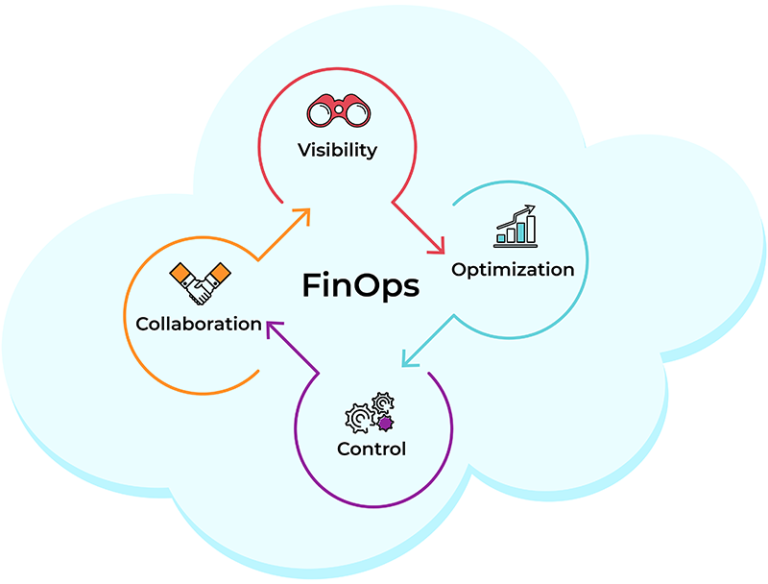

FinOps is a process and a set of best practices to bring the following aspects to companies and stakeholders:

- Visibility – cloud spending transparency and forecasting

- Optimization – cloud expense optimization

- Control – an established process of monitoring and controlling cloud resources and their expenses

- Collaboration—FinOps is not about one person at a company but a constant collaboration between engineers and their managers, between R&D, Operations, and Financial departments, the CTO, CIO, and the VPs’ offices.

Here is a list of people (but not limited to just those positions) engaged in the FinOps process: CTO, CIO, VPs and Directors of Engineering / Ops / DevOps, CFO, financial controllers and analysts, Engineering managers, project managers and, of course, engineers who work directly with clouds.

Before we discuss the steps to adopt FinOps, let’s define the end goal—to build a transparent and defined process in which clouds are used optimally from a cost, performance, R&D, and company goals perspective, and money waste is set to a minimum.

What needs to be done to build the FinOps at your company:

- The most challenging step is getting a push from the company executive team to adopt FinOps. The process can’t be established (but some of the practices can be used) if the CTO, CIO, CFO, and VPs don’t intend to do so, as they need to motivate their teams and build collaboration.

- Create a team responsible for the FinOps adoption. It should define the procedure, timeline, and best practices to implement. At least one team member should come from engineering, operations, DevOps, and financial teams to cover multiple aspects of the problem.

- Constant education. If you don’t explain to your engineers why they need to keep costs in mind and what process to follow, you will not succeed. First of all, FinOps is about a process and only then about some granular actions.

- Start small, grow later. Don’t try to scale the process to the whole company. Start with one team, establish a process, and then scale it to other teams and departments.

- Use cloud cost management and cloud arbitrage solutions to assist with FinOps adoption. Multiple tools are available on the market that can help with cost management, optimization, and optimal resource provisioning.

- Measure and adjust. It would be best to remember that FinOps differs for multi-cloud and hybrid cloud environments. Not all the recipes work for every company. The FinOps adoption team should have regular sync-ups to control results and adjust if necessary

FinOps is a new term and the community is just developing but it’s the right move to help big companies adopt clouds in a smart, secure and transparent way. Start small and you will see positive results soon.

Nick Smirnov, CEO at Hystax