Nuvens bare metal, privadas e públicas são diferentes não apenas na maneira como seus recursos são provisionados e mantidos, mas na maneira como seus departamentos de compras e financeiro devem tratá-los e lidar com eles.

Metal puro e nuvens privadas na maioria dos casos são about CapEx, quando as empresas compram e atualizam licenças de hardware e software em alguns ciclos, alugam espaço e energia e pagam salários ao pessoal. Nuvens públicas são baseadas em OpEx com contas mensais ou anuais e uma mentalidade de alugar, mas não de possuir. Se você é uma empresa pequena, não é um grande problema ajustar seus processos, mas para uma empresa grande é uma verdadeira dor: nuvens privadas com CapEx, públicas com OpEx, equipes de engenharia provisionando recursos em vários locais e sem limites em nuvens públicas se transformando em contas enormes, departamentos financeiros tendo recursos locais e públicos e diferentes categorias de contabilidade. Tudo isso é um grande obstáculo para a adoção da nuvem em grandes empresas e a razão pela qual elas ainda preferem não adotar a nuvem híbrida.

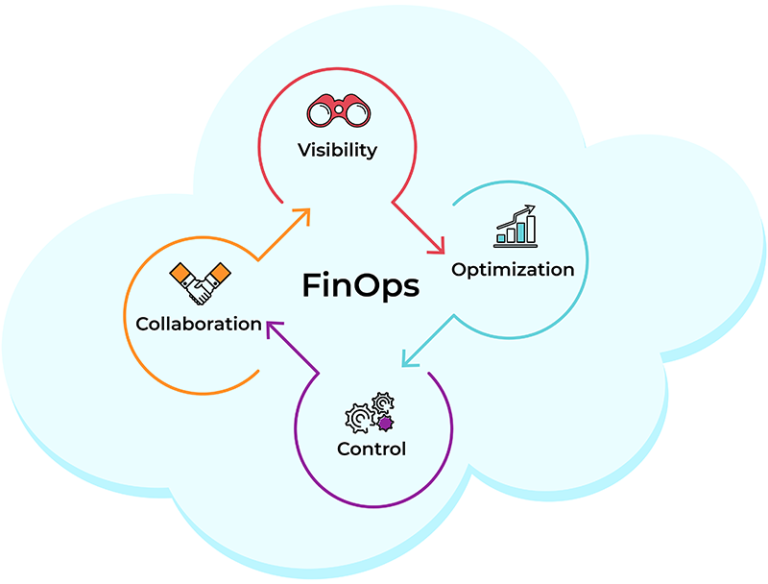

Para eliminar a barreira, a metodologia FinOps foi criada e está se desenvolvendo ativamente atualmente com milhares de profissionais e empresas como membros e patrocinadores.

FinOps é um processo e um conjunto de boas práticas para trazer os seguintes aspectos para empresas e stakeholders:

- Visibilidade – transparência e previsão de gastos na nuvem

- Otimização – otimização de despesas na nuvem

- Controlar – um processo estabelecido de monitoramento e controlando recursos de nuvem e suas despesas

- Colaboração—FinOps não é sobre uma pessoa em uma empresa, mas uma colaboração constante entre engenheiros e seus gerentes, entre os departamentos de P&D, Operações e Financeiro, o CTO, o CIO e os VPs. escritórios.

Aqui está uma lista de pessoas (mas não limitadas apenas a esses cargos) envolvidas no processo FinOps: CTO, CIO, VPs e Diretores de Engenharia/Ops/DevOps, CFO, controladores e analistas financeiros, gerentes de engenharia, gerentes de projeto e, claro, engenheiros que trabalham diretamente com nuvens.

Antes de discutirmos as etapas para adotar o FinOps, vamos definir o objetivo final—construir um processo transparente e definido no qual as nuvens sejam utilizadas de forma otimizada a partir de uma perspectiva de custo, desempenho, P&D e objetivos da empresa, e o desperdício de dinheiro é definido como mínimo.

O que precisa ser feito para construir o FinOps na sua empresa:

- O passo mais desafiador é obter um empurrão da equipe executiva da empresa para adotar o FinOps. O processo não pode ser estabelecido (mas algumas das práticas podem ser usadas) se o CTO, CIO, CFO e VPs não pretenderem fazê-lo, pois eles precisam motivar suas equipes e construir colaboração.

- Crie uma equipe responsável pelo Adoção de FinOps. Deve definir o procedimento, cronograma e melhores práticas a serem implementadas. Pelo menos um membro da equipe deve vir de engenharia, operações, DevOps, e equipes financeiras para cobrir múltiplos aspectos do problema.

- Educação constante. Se você não explicar aos seus engenheiros por que eles precisam manter os custos em mente e qual processo seguir, você não terá sucesso. Primeiro, FinOps é sobre um processo e só então sobre algumas ações granulares.

- Comece pequeno, cresça depois. Não tente escalar o processo para toda a empresa. Comece com uma equipe, estabeleça um processo e então escale-o para outras equipes e departamentos.

- Usar gerenciamento de custos de nuvem e soluções de arbitragem em nuvem para auxiliar na adoção do FinOps. Várias ferramentas estão disponíveis no mercado que podem ajudar com gerenciamento de custos, otimização e provisionamento ideal de recursos.

- Medir e ajustar. Seria melhor lembrar que o FinOps difere para ambientes de nuvem híbrida e multi-nuvem. Nem todas as receitas funcionam para todas as empresas. A equipe de adoção do FinOps deve ter sincronizações regulares para controlar os resultados e ajustar, se necessário

FinOps é um termo novo e a comunidade está apenas se desenvolvendo, mas é a jogada certa para ajudar grandes empresas a adotar nuvens de forma inteligente, segura e transparente. Comece pequeno e você verá resultados positivos em breve.

Nick Smirnov, CEO na Hystax